Dubai, a hive of foreign commerce and investment, has a lively business scene that draws companies and entrepreneurs worldwide. In these dynamic surroundings, knowledge of company valuation is critical. Beyond counting assets, business valuation in Dubai is a vital procedure that affects investment choices, strategic planning, and general corporate performance in the Emirates.

Importance of Dubai Business Valuation

Business valuation is establishing a company’s or its assets’ economic value. Given the numerous circumstances in Dubai, this procedure has special importance:

Investment Prospects:

Dubai’s appealing investment environment requires precise appraisals for mergers and acquisitions, draws in foreign direct investment, and guarantees financing from domestic and foreign investors. A well-founded business valuation in the UAE helps to enable easier transactions and gives potential investors confidence.

Effective Planning:

Beyond deals, company valuation is an excellent tool for internal strategic planning. It clarifies a firm’s inherent worth, points out areas needing work, and guides its choices about restructuring, divestment, or growth.

Compliance with Regulators:

Businesses in Dubai are obliged to go through the procedures of official business valuation in the UAE under several circumstances, such as financial reporting, taxes, and dispute resolution. Compliance depends critically on following local rules and international valuation guidelines.

Plans of Growth and Success:

For family-owned companies, which account for a significant portion of Dubai’s GDP, succession planning depends much on firm value. It guarantees a seamless passing between generations and helps ascertain the appropriate value for changing ownership.

Measuring Performance:

Benchmarks for performance evaluation might come from routine small business valuations. Tracking changes in worth over time helps companies evaluate how well their plans work and spot areas where value is generated or lost.

Revealing The True Value: Tangible and Intangible Assets

Although a company’s worth consists of its physical assets—property, plants, machinery—a thorough valuation in Dubai takes into account a much wider range of elements:

Intangible Business Assets Valuation:

In today’s knowledge-driven market, intangible assets may add much to a business’s value. These include brand awareness, intellectual property (copyright, trademarks, patents), customer connections, reputation, and privately held technology. Dubai’s emphasis on technological innovation makes these resources very valuable.

Revenue Potential:

The firm’s capacity to create future profits is fundamental to business valuation in Dubai. Analyzing past financial results, projecting future income and costs, and evaluating profitability and sustainability all fall within this purview. Aspects like managerial experience, competitive environment, and market demand largely influenced revenue potential.

Market Trends and Dynamics:

The general economic environment and particular industry trends strongly influenced business values in Dubai. We provide an excellent overview of points, like GDP growth, interest rates, inflation, legislative changes, and industry degree of competitiveness. Dubai’s status as a worldwide trading center makes it especially vulnerable to the dynamics of the world markets.

Risks Variables:

Every company has risks, which are included in the valuation process. Financial hazards (e.g., the degree of debt, liquidity), operational hazards (e.g., supply chain interruptions, key person dependency), and market uncertainties (e.g., changing customer preferences, new entrants) all come under this category. Usually, higher perceived risks translate into smaller values.

Quality of Management:

Significant markers of a company’s future success and, thus, its worth are the management team’s experience, knowledge, and performance record. Dubai’s investors highly value businesses with skilled and strong leadership.

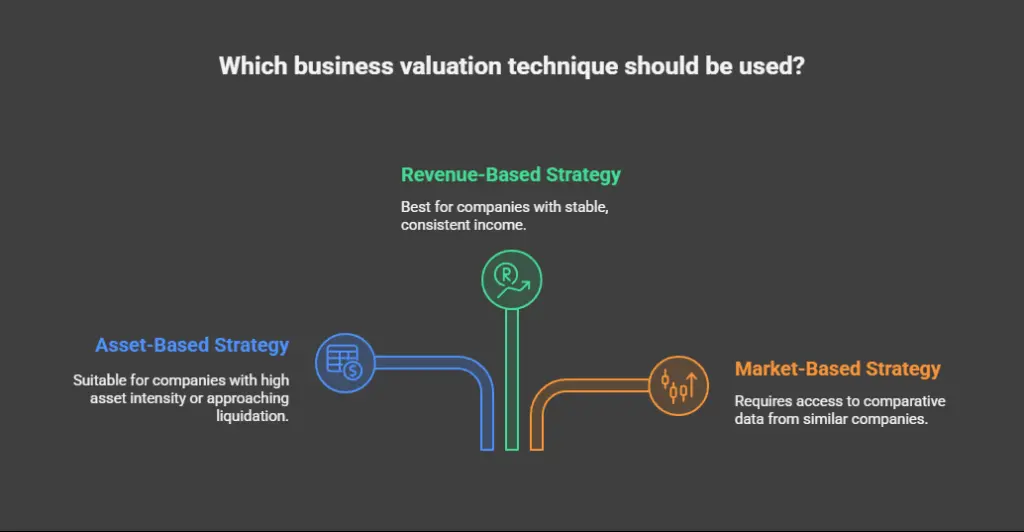

Effective Business Valuation Techniques

Different approaches for business valuation in Dubai are used to ascertain the worth of a company. The particular situation, the sector, and the availability of trustworthy data will determine the approach to be used:

Strategy Based on Assets:

Using the company’s net asset value, the entire worth of its assets minus its liabilities is calculated. This approach emphasizes simplicity. Usually undervalued companies with high intangible assets or great earning capacity. It is best suited for companies approaching liquidation or those with a high asset intensity.

Approach Based on Revenue:

These strategies respect a company depending on its future capability for profitability. Most often used income-based strategy consists of the following:

Analyze Discounted Cash Flows:

This approach predicts the company’s foreseeable free cash flows. It discounts them to their current value using a suitable discount rate corresponding to the risk associated with those free cash flows. Its prospective viewpoint and capacity to include many presumptions regarding future performance are much appreciated.

Method of Capitalizing Revenues:

This approach uses a company’s sustainable profits to project its value at a suitable capitalization rate. Stable, established companies with consistent income generally find use for it.

Strategies Based on Market Measures:

This strategy evaluates the subject firm in line with comparable publicly listed companies or recent acquisitions of such companies in the same sector and area. One derives a value using key measures like revenue multiples and profit multiples. For this approach, access to consistent comparative data is vital.

Business Valuation Impact: Investment Strategy

Marketing strategies and investment choices depend much on accurate business valuation in Dubai:

Decisions Regarding Investments:

A comprehensive valuation gives investors a foundation for deciding a reasonable price to pay for a share in a company or to buy it whole. It clarifies the possible return on investment and the related hazards for them. In Dubai’s competitive investment scene, a well-supported value could be the determining element in getting money or drawing in purchasers.

Strategic Choices:

Valuation data may guide important strategic choices for management teams and company owners. Knowing the factors of business valuation in the UAE will enable one to concentrate on actions to improve profitability and long-term development. Should brand awareness be a significant value driver, for instance, the business may increase marketing and brand development investments.

On the other hand, the company could consider selling any underperforming assets if they are pulling down the general value.

Dynamic Mergers and Acquisitions Market:

Accurate appraisal is crucial for buyers and sellers in Dubai’s dynamic merger and acquisition market if they are to negotiate reasonable transaction terms. Undervaluation might cause the seller to leave funds. Overvaluation can cause a failure in selling or buyer’s regret. A fair and open procedure depends much on independent valuation professionals.

Raising Funds:

Companies seeking financing from Dubai banks, private equity companies, or venture capitalists must provide a strong value to support their funding calls. A ready-made valuation report shows the company’s promise and ensures that investors will contribute more funds.

Final Words

Business valuation in Dubai is a complex process beyond the basic computation of physical assets. It covers analysis of intangible assets, earnings potential, market circumstances, risk considerations, and management caliber. In the dynamic and competitive environment of the Emirates, better investment choices, effective strategic planning, and sustained company development depend on using suitable valuation techniques and knowing their consequences.

The precise demand and thorough company appraisal will become more crucial as Dubai develops into a worldwide corporate center.

FAQs

How can Dubai startup companies benefit from professional business appraisal services?

Professionals give an unbiased value, help with discussions with buyers and investors. They ensure the company complies with the UAE laws, and help with the development of plans for improvement and exit.

What is the value of a business, and why is it significant in Dubai?

Business valuation looks at a company’s finances and the market to figure out how much it’s worth. It’s highly significant in Dubai for setting fair pricing during mergers and acquisitions, getting investors, and ensuring legal compliance.

When should a Dubai-based firm get a business valuation?

A business should get a valuation before selling or buying, when getting funds from investors, for shareholder conflicts, or to ensure legal and tax compliance.

What are the most prevalent methods to value a firm in the UAE?

The three primary ways are the Revenue Approach, the Market Technique, and the Asset-Based Method.

What variables affect the worth of a firm in Dubai?

Key variables are the company’s steady financial performance, the industry’s development potential, the strength of its management, marketplace circumstances, and the worth of its intangible assets.