Are you a freelancer, small business owner, or even an influencer wishing to trade or provide services online in Dubai? The e-trader license offers a simple and reasonably priced approach to run legally and impulsively in Dubai’s booming digital economy. The latest projection shows the sector’s clear growth trend driven by broad digital adoption and ongoing investment in online infrastructure.

Understanding the e-trader license is essential to join the explosive e-commerce business. From eligibility and allowed activities to expenses and application processes, this article guides you through every detail you desire to know about the Dubai e-trader license.

E-Trade License in Dubai: Introduction

Aimed at encouraging e-commerce and allowing people to undertake commercial operations online via social media platforms, internet sites, and other digital platforms, the e-trader license in Dubai is a government endeavor. Small companies and entrepreneurs working in the digital arena especially benefit from this e-trader license in Dubai, which lets them lawfully engage in commercial operations via several online channels.

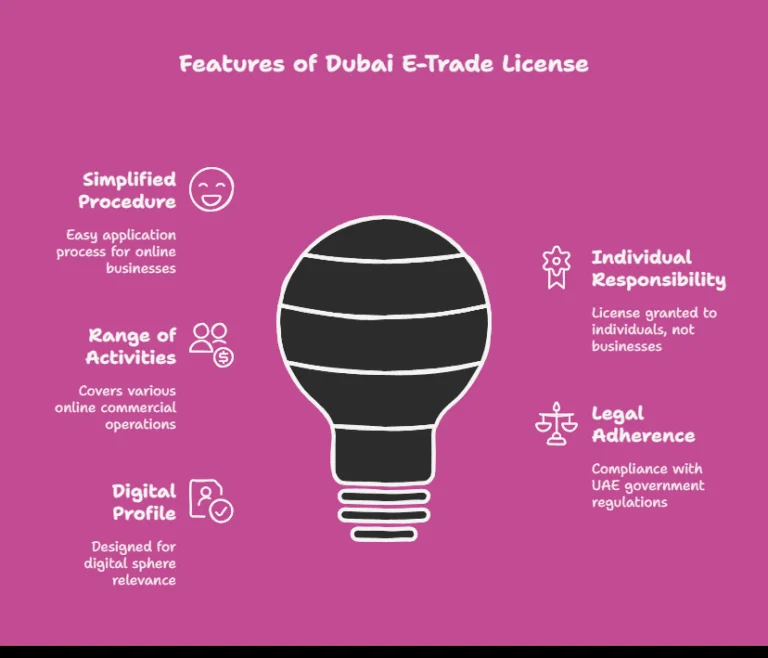

Exploring the Exclusive Features of E-Trade License in Dubai

Simplified Procedure:

For those who want to launch or grow their online companies, the e-trader license application procedure is really simple and easily available.

Individual Responsibility:

The e-trader license is special as it is granted to individuals instead of businesses. It implies that one individual may get and run under this license alone.

Range of Activities:

The Dubai e-trader license covers a range of online commercial operations, including individual websites, social networking platforms, retail products, promoting services, and other online venues.

Legal Adherence:

Although the e-trader license streamlines procedures, users must follow specific UAE government rules and requirements. It guarantees fair and legitimate corporate behavior.

Digital Profile:

The license is meant for those who work in the digital sphere. It captures the rising relevance of e-commerce in the corporate scene of Dubai.

Requirements and Criteria for E-Trade License in Dubai

There are certain important things to remember for obtaining a trade license in Dubai. The qualifying requirements for an e-trade license in the UAE are really simple.

- Every candidate has to be a minimum of twenty-one years old.

- Candidates have to be current UAE citizens with an Emirates ID.

- If they live in Dubai, citizens from GCC nations may seek a license.

- UAE citizens qualify for a license free from any limitations.

- For expatriates, certain foreign nationals from particular countries might be eligible for the e-trader license in Dubai.

- The company must have a registered trade name.

Simplified Process for Acquiring an E-Trade License in Dubai

For company owners looking to operate online or via social media, the Dubai e-trader license is the perfect option. This detailed content will give you an overview of the application process:

Verify Eligibility:

Make sure you satisfy the e-trader license’s eligibility conditions, live in Dubai, satisfy the age requirements, and want to operate personally rather than under a corporation.

Provide Necessary Documents:

The Dubai e-trader license documentation consists of the following:

Must be based in Dubai and have a current Emirates identification number.

There is a minimum relevant age of twenty-one.

Copies of your passport, if relevant.

Passport-sized recent pictures.

Accommodation proof.

Any additional documentation that the authorities have specified.

Register A Business Name:

Choose a distinctive and related brand name for your internet-based business. Make sure the name conforms to DED authority recommendations.

Business Registration:

Your company should register with the DED authority. Complete the application, including specifics about your company operations, suggested business name, and any other necessary information. Pay the e-trader license’s relevant fees.

Review of Applied Skills:

The DED authorities will verify your application and e-trade license activities. This procedure might take some time; the official web portals allow you to monitor the status of your application.

Obtain E-Trader License:

Your Dubai e-trader license will be provided upon approval of your application. Make sure you follow any extra guidelines or instructions given specifically.

It is specially designed for entrepreneurs operating online within Dubai’s mainland jurisdiction. The Dubai e-trader license cannot be utilized in a free zone or distinct economic zones with their own guidelines and policies.

You must get a license from the relevant free zone administration to work in one of Dubai’s free zones. Every free zone has unique licensing policies and costs.

Authorized Business Activities for E-Trade License in Dubai

The e-trader license in Dubai provides access to a wide spectrum of online businesses in the UAE and commercial operations, including:

- Online sales of goods include clothes, accessories, gadgets, handcrafted goods, and more.

- Service-based companies in graphic design, content writing, software and website development, consultancy, and other internet offerings.

- Marketing goods or services on social media sites.

- Creating and marketing instructional tools or online courses.

- Providing online consulting or counseling services.

- Offering consumers digital marketing solutions.

- Sales of any other online goods.

Unauthorized Business Activities for E-Trade License in Dubai

- Property trade and real estate broking.

- Medical and health-related services.

- Medications trading.

- Wholesale distribution or massive import and export.

- Services related to finances and insurance.

- Industrial manufacturing is also known as factory operations.

- Food companies include restaurants and caterers without separate licenses.

- Operations of travel agencies, logistics, or transportation.

- Activities calling for a physical company location, such as salons and clinics.

Estimated Costs of E-Trade License in Dubai

Comprising the basics, one thousand seventy AED is the base cost of acquiring a Dubai e-trader license. According to your particular needs, more expenses include three hundred AED for membership in the Dubai Chamber of Commerce, and extra expert services might add to the overall e-trader license Dubai cost.

An E-Trader License vs. an E-Commerce License in Dubai

Designed especially for self-employed professionals or entrepreneurs, freelancers, influencers, or small-scale firms running online from home. They are mostly offering services or limited product sales. An e-trader license is meant for you. It forbids recruiting staff, leasing business space, or sponsoring visas.

On the other hand, an e-commerce license serves more extensive online companies engaged in the actual goods and services. It is appropriate for companies looking for expansion as it lets them establish themselves, hire staff, sponsor visas, import and export items, and rent actual office or warehouse space.

What Types of Businesses Need an E-Trade License in Dubai?

As long as your resident status is legitimate, everyone is essentially regarded as a beneficiary of this licensing privilege. Still, here are several groups of individuals who could find e-trading more practical:

Housewives or stay-at-home moms who have decided to work from home. This e-trader license in Dubai is a great advantage to highlight their talents, handcrafted goods, or services.

Freelancers utilize this platform to connect with those looking to pay them for a certain job.

Start-up companies still lack sufficient capital to open or expand a workspace.

Online traders or entrepreneurs who believe they create additional prospects or sales.

One should be aware that more than one individual cannot register under one license.

Restrictions for Dubai E-Trade License

The residence status of the license holder determines the range of activities allowed under a Dubai e-trader license. Dubai’s foreign population suffers more severe constraints than UAE or GCC citizens.

Furthermore, unable to run fitness-related companies are expats having e-trader licenses. In line with UAE Sports Ministry rules, this limitation includes all sports activities, personal training, and yoga courses.

Conversely, with the e-trader license, UAE and GCC residents have more rights. Enjoying more freedom in economic operations, they can sell tangible goods, cook, and sell meals from home.

Final Words

For small business owners, particularly when more commerce is conducted online, the e-trader license in Dubai is revolutionary. From offering professional services via social media to selling handcrafted goods, it gives you an appropriate way to profit from Dubai’s fast-growing digital economy. Knowing the expenses, rules, and opportunities can help you to start or grow your internet business in the Emirate.

FAQs

Who is eligible to apply for a Dubai e-trader license?

UAE and GCC nationals residing in Dubai and selling their products or services through social media or online platforms are eligible to apply for an e-trader license.

What activities are allowed and not allowed under an e-trader license in Dubai?

Allowed activities include selling services, home-based products, consultancy, and online promotions. Activities involving physical trading, rented shops, or imported goods are not permitted under this license.

How much does it cost to obtain a Dubai e-trader license?

The license fee is set by Dubai Economy and can vary slightly year to year.

What documents are required for the e-trader license application?

A valid Emirates ID, residence details, and information about online business activity are required as part of the application.

What is the difference between an e-trader license and an e-commerce license in Dubai?

The e-trader license is for individuals operating from home with online-only services or small-scale sales. The e-commerce license is for larger commercial operations that may involve physical trading, offices, or warehouses.