Running a business in the UAE? Then you’ve probably heard about VAT (Value Added Tax). It is a simple concept with big implications. Introduced in January 2018, VAT has become a vital part of business operations across the country. Whether you’re just launching your venture or scaling up, VAT registration isn’t something you can afford to ignore.

In this guide, we’ll walk you through:

- Why VAT registration is a must-have

- Who needs to register (and when)

- How to register step-by-step

- Documents you’ll need

- Smart tips to stay compliant once you’re registered

Let’s get started with the essentials.

What is VAT, and Why Does It Matter?

Think of VAT as a small slice added at every step of a product’s journey, from raw material to final sale. Businesses collect this tax on behalf of the government and pay it forward. The system rewards transparency and good record-keeping, and it helps fund public services without hitting consumers all at once.

Quick Example:

| Stage | Cost (AED) | VAT (5%) | Total Price | Who Pays |

| Manufacturer | 100 | 5 | 105 | Retailer |

| Retailer Adds Value | 130 | 6.5 | 136.5 | Consumer |

| Final Sale | 150 | 7.5 | 157.5 | End User |

The good news? You can claim back the VAT you pay on your business expenses. That’s called input tax credit, and it’s one of the biggest reasons to get your VAT registration in the UAE done right.

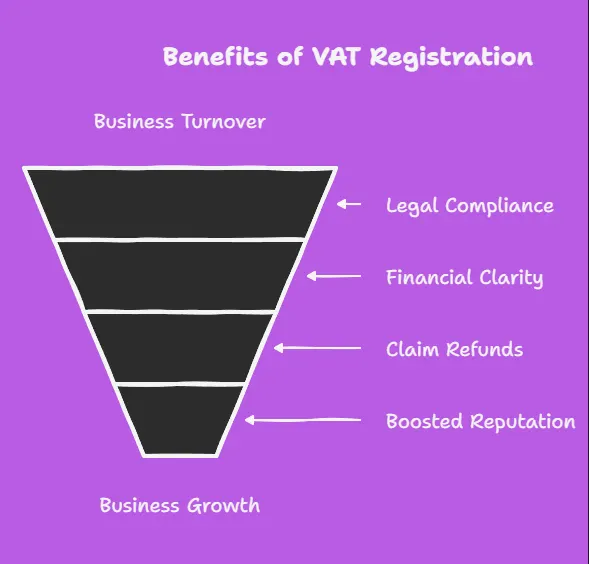

Why Registering for VAT Is a Smart Move

Here’s why registering isn’t just a legal obligation. But, it’s a smart business strategy:

Legal Protection

Avoid hefty penalties by registering on time. If your taxable turnover crosses AED 375,000, you must register within 30 days.

Financial Clarity

Registered businesses often keep cleaner, clearer records. This gives you better insights into cash flow, pricing, and growth.

Claim Refunds

You can request a refund if your input VAT (expenses) is more than your output VAT (sales). That’s money back in your pocket.

Boosted Reputation

Clients and partners take you more seriously when you’re VAT-registered. It shows you’re legit and compliant.

Who Needs to Register for VAT in the UAE?

VAT registration in the UAE comes in two categories. These are named as Mandatory and Voluntary.

Mandatory Registration

You must register if your total taxable turnover exceeds AED 375,000 in the last 12 months

Similarly, you expect to exceed that amount in the next 30 days. This includes sales of goods and services in the UAE. Including the import of goods or services.

Voluntary Registration

You can choose to register if your turnover is above AED 187,500 but below AED 375,000. If you’re a startup or small business looking to claim VAT on business expenses

VAT Exemptions

Some industries don’t need to register. These include:

| Sector | VAT Status |

| Residential Property | Exempt |

| Local Passenger Transport | Exempt |

| Bare Land | Exempt |

| Certain Financial Services | Exempt (non-fee based) |

If your business only deals in exempt supplies. In this scenario, you don’t need to register.

Step-by-Step: How to Register for VAT in the UAE

Wondering how to do VAT registration in the UAE? Let’s break it down into simple steps:

1. Check Your Eligibility

Review your turnover and forecast upcoming sales. Decide if mandatory or voluntary registration applies

2. Prepare Required Documents

Below are the documents required for VAT registration in the UAE:

- A Trade License is required for business identification

- The Emirates ID / Passport of the Signatories needs to be verified to confirm the identity of the business owners

- Bank Letter confirms the business bank account

- The Memorandum of Association defines the structure and operations

- Address and Contact Info ensure traceability

- Custom Code (if importing/exporting) is needed for businesses trading goods

- Financial Reports (past 12 months) prove eligibility for VAT registration in the UAE

3. Create an Account with the FTA

Visit eservices.tax.gov.ae and set up your online FTA account

4. Complete the VAT Registration Form

Provide business details and enter turnover, activity types, and import/export info. Upload documents as required.

5. Submit Your Application

Double-check all info and submit the form online

6. Get Your TRN (Tax Registration Number)

The FTA will send you a TRN if everything checks out. You’ll also receive your official VAT Certificate. Registration usually takes 20–30 business days.

How to Stay Compliant After Registration

Once you’ve registered, your responsibilities don’t end. Here’s how to keep everything in check:

Charge VAT on All Eligible Sales

Add 5% VAT to your sales invoices and display it clearly.

Keep Clear Records

Maintain organized books for sales invoices, expense receipts, and import/export documents. You need to store these for at least five years.

File VAT Returns on Time

You must file quarterly or monthly VAT returns through the FTA portal. The return summarizes VAT collected (sales), VAT paid (expenses), and the total amount owed or refundable.

Issue Valid VAT Invoices

Each invoice should include your TRN, invoice date and number, VAT breakdown, buyer and seller details.

Be Ready for Audits

The FTA can audit your records. Keep everything digital and easy to access to avoid last-minute stress.

Penalties You Should Avoid

Staying compliant avoids these fines:

| Mistake | Fine Amount |

| Late VAT registration | AED 10,000 |

| Late payment of VAT | 2% of unpaid tax + 4% monthly |

| Incorrect records or info | Up to AED 50,000 |

| Late return filing | AED 1,000 (first time), AED 2,000 (repeat) |

Make VAT Simpler with Technology

Handling VAT manually can be stressful. A spend management tool can help ease the process.. It automatically applies the correct VAT rates. Helping you to track purchases and invoices. You can calculate VAT owed with precision. The apps generate reports ready for filing. Using it saves time, reduces errors, and keeps you on top of your tax game.

Final Thoughts

VAT registration isn’t just another formality, but it’s your entry pass to running a compliant, efficient, and credible business in the UAE. Getting started is easier than ever. Achieve a clear threshold, a straightforward process, and helpful digital tools.

Don’t wait! If your business is nearing the VAT threshold or you’re ready to take that next step. Register on time, keep clean records, and take control of your finances.

Need Help Automating Your VAT Process?

Reach out to Al Buraq if you need assistance regarding your VAT. Pay on time and accurately with our support. We want you to stay ahead of time so you’ll never miss any updates and details. Al Buraq provides support with everything, whether it’s meeting the eligibility criteria, required documents, applying for FTA, or submitting your application timely manner.

Make your VAT registration in the UAE as simple as possible with Al Buraq Consultancy. Not only this, we’ll guide you through the best tools and practices to make VAT easy.